Recent Developments & Market Context

Banana For Scale (BANANAS31) is a meme coin running on the BNB Smart Chain that somehow managed to grab everyone’s attention through viral internet memes and wild marketing moves—including slapping a sticker on a SpaceX rocket. The thing is, nobody really knows who’s behind it. There’s no team list, no white paper, no roadmap, and definitely no GitHub to peek into. That’s already raising eyebrows. What really sets off alarm bells though is that roughly 80% of all tokens are sitting in just a handful of wallets. Analysts and watchdogs have been waving red flags about potential manipulation or pump-and-dump schemes for months now, with formal warnings going out as recently as six months ago.

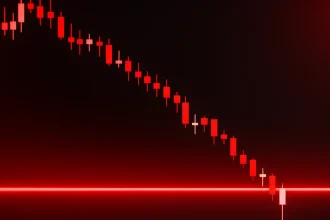

Still, BANANAS31 had its moment in the spotlight. Back in July 2025, the price absolutely exploded—shooting up over 200% in just a few days as trading volume went through the roof and speculators piled in. But that party didn’t last. Right now, the token is trading around $0.0043, which is a brutal drop of more than 90% from its peak near $0.059. Ouch.

Technical Indicators & Price Structure

If we zoom into the recent four-hour chart, the Relative Strength Index (RSI) is hovering around 56.8. That’s neutral ground—not oversold enough to scream “buy the dip,” but not overbought either. The moving averages paint a similar picture. The Simple Moving Average (SMA) over the last four hours sits at about $0.004247, which is just a hair above the current price of $0.00431025. The Exponential Moving Average (EMA) is trailing slightly lower at around $0.004205. Basically, there’s a little upward nudge happening, but nothing strong enough to call it a trend yet.

The MACD on the four-hour timeframe shows the MACD line sitting above the signal line (0.0000343 versus 0.0000198), and that’s creating a positive histogram. Translation: there’s some short-term bullish momentum starting to build, though it’s still early and fragile. When we look at the daily pivot points, resistance levels are stacked pretty tight—around $0.004347 (R1), $0.004371 (R2), and $0.004392 (R3). On the flip side, support sits near $0.004302 (S1), $0.004281 (S2), and $0.004257 (S3). This tells us the token is trading in a narrow box right now, and it’ll take either a surge in volume or some news to break out either way.

Price Prediction & Risk Considerations

Looking ahead in the short term, there are really two paths this could take:

- Neutral-to-slightly-bullish case: If the current momentum holds up, BANANAS31 might push toward that first resistance level around $0.00435. If buyers really show up and punch through R2 at roughly $0.00437 and then R3 near $0.00439, we could actually see a climb toward $0.0050. For that to happen though, you’d need volume to pick up meaningfully, the MACD to stay positive, and RSI to creep into the 60-65 zone without hitting exhaustion. Any surprise news—like a new exchange listing or viral buzz—could be the spark.

- Bearish/downside case: If buying interest fizzles out and no catalysts appear, the price could easily drift lower. First stop would be S1 around $0.00430. Breaking below that opens the door to S2 near $0.00428, and if things get ugly, S3 at roughly $0.004257. Given how concentrated the token holdings are, a slide below these supports could trigger panic selling. If the MACD weakens or RSI dips below 50, that would back up this downside scenario.

Longer-Term Outlook

Over the next few weeks to a couple of months, getting back to the $0.0050–$0.0060 range isn’t impossible, but it’s not exactly likely either unless something changes. The project would need to show signs of life—maybe some transparency, a dev update, a major listing, or a broader rally in the meme coin space. On the other hand, the risks here are huge. It’s entirely reasonable to expect another 50% drop or worse if things go south.

Final Insight: High Reward, High Risk

Right now, BANANAS31 is at a fork in the road. The technicals suggest there’s a sliver of upside opportunity, but you can’t ignore the giant red flags waving in the background—centralized holdings, anonymous team, no real product, and a track record that screams caution. If you’re thinking about getting in or holding, make sure you’ve got a clear exit plan, keep your position size small, and understand that this token can swing violently in either direction. This is not a “set it and forget it” investment.