Current Technical Overview and Macro Fundamentals

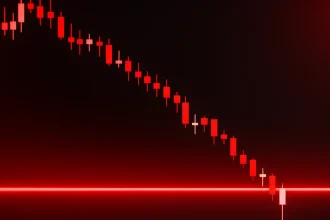

JUST (ticker JST/USDT) is currently trading around $0.04179, which represents a pretty significant drop of roughly 9.7% in just the last 24 hours. Looking at the 4-hour charts, it’s clear that JST is facing some serious selling pressure right now. The Relative Strength Index (RSI) is hovering near 39.1—well below that neutral 50 mark we like to see—and the MACD line has dipped below its signal line, with the histogram showing negative values. All of this points to momentum that’s trending downward.

We’ve also seen some unusual moves in volume and volatility lately. The daily pivot points tell an interesting story: support levels (S1, S2, S3) are sitting at $0.04064, $0.03941, and $0.03873, while resistance levels (R1, R2, R3) are hanging around $0.04255, $0.04323, and $0.04446. The main pivot point is at $0.04132.

That said, the bigger picture isn’t all doom and gloom. JST has some genuinely strong fundamentals working in its favor. The project runs on a deflationary tokenomics model that includes regular buyback and burn mechanisms—they’ve already burned over 10-11% of the total supply, which is pretty substantial. JustLend DAO is backing this up with quarterly burns and promises of better revenue transparency down the line. On top of that, their push toward multi-chain deployments and full DAO governance could really boost both utility and demand if they pull it off successfully.

Short-Term Price Scenarios and Key Levels

With the recent 24-hour decline and where the technicals stand now, we’re looking at two possible paths in the short term:

– Bearish continuation: If JST can’t hold above that critical support zone around $0.0412–$0.0406, we could see it slide down toward the S2 pivot near $0.0394 or even hit S3 around $0.0387. Breaking through these levels would probably trigger a bunch of stop-losses and could push it down to test those lower demand zones near $0.036 to $0.035. The MACD histogram is showing us that momentum is weakening, and with RSI still stuck below 50, bears might have the upper hand here.

– Recovery potential: On the flip side, buyers might step in to defend that pivot area around $0.0413. If buying pressure comes back and we see a clean break above resistance at $0.0425–$0.0445—particularly if it can push above those 20- and 50-period EMAs—JST could start to regain some strength. A solid move above $0.0445 might open the door to targeting $0.0470 next, especially if those token burns keep happening and on-chain activity stays healthy.

Indicators & Sentiment Signals to Watch Closely

• Keep an eye on the MACD line versus the signal line on both 4-hour and daily timeframes—any crossover could signal a shift in direction.

• Watch if RSI dips into oversold territory (below 30) or manages to climb back above 50, which would suggest buying strength is returning.

• That support zone at $0.0412–$0.0406 is crucial—if it breaks, we could be in for a deeper bearish move.

• The resistance cluster near $0.0425–$0.0445 is equally important: closing above this level could unlock some real upside potential.

• Pay attention to quarterly burn announcements and protocol revenue updates, since these are core to JST’s deflationary model and can serve as major catalysts.

Medium-Term Outlook: Forecasts and Risks

Looking out over the next few weeks to months, assuming the ecosystem fundamentals stay solid, JST could gradually work its way back toward $0.045–$0.050. Growth in TRON’s DeFi activity, successful expansion to multiple chains, and those ongoing buyback burns all provide a decent structural foundation for this kind of recovery. Some market models are even projecting end-of-year targets in the $0.055-$0.060 range if conditions stay favorable.

But let’s be real—there are still some significant risks to consider:

– A broader market downturn can send altcoins tumbling regardless of how solid their fundamentals are.

– Competition from other blockchain platforms offering better yields and more flexible multi-chain capabilities could siphon off capital.

– If user growth stalls or protocol revenue doesn’t hold up, the burn mechanism loses its punch, which means less scarcity and potentially less upward price pressure.

Bottom line: JST is definitely in a tough technical spot in the near term, with bearish indicators and recent losses weighing it down. But the medium-term fundamentals offer a reasonable foundation for a potential comeback—especially if those key support levels hold and the deflationary mechanisms keep doing their thing. Anyone trading or investing in JST should be watching both the chart levels and on-chain metrics closely to figure out whether this bearish phase deepens or eventually gives way to a fresh uptrend.