Market Overview

The cryptocurrency market has experienced notable fluctuations as of January 28, 2026. Bitcoin (BTC) is currently trading at $89,042, reflecting a modest increase of 0.94% over the past 24 hours. Ethereum (ETH) has also seen a rise, reaching $3,002.26, up by 2.65%. The total market capitalization has grown to $3.02 trillion, marking a 1.49% increase from the previous day. Despite these gains, the market remains cautious ahead of the Federal Reserve’s upcoming decision on interest rates, which could significantly influence investor sentiment.

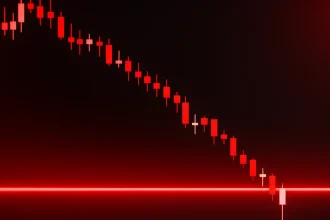

Bitcoin’s Performance Amid Economic Uncertainty

Bitcoin’s price has been oscillating below the $90,000 threshold, with recent attempts to stabilize around $89,000. This movement comes after a decline from its all-time high of approximately $125,000 in August 2025. The cryptocurrency’s performance is closely tied to macroeconomic factors, including the Federal Reserve’s monetary policies and global economic indicators. Investors are keenly awaiting the Fed’s upcoming meeting, as any changes in interest rates could impact Bitcoin’s appeal as a risk asset.

Ethereum’s Continued Development and Market Position

Ethereum has successfully implemented the “BPO” hard fork, a significant update aimed at optimizing network efficiency and finalizing the broader Fusaka upgrade series. This development underscores Ethereum’s commitment to scalability and its pivotal role in decentralized finance (DeFi) and smart contracts. Despite a slight dip below $3,000 earlier in the week, Ethereum has rebounded, reflecting investor confidence in its long-term prospects.

Regulatory Developments and Institutional Movements

The U.S. cryptocurrency landscape is undergoing significant regulatory changes with the introduction of the Clarity Act. This legislation aims to provide a comprehensive framework for digital assets, delineating the roles of the SEC and CFTC, and establishing federal rules for stablecoins. Such measures are expected to transform the cryptocurrency market into a more institutionally integrated financial sector. In parallel, investment firms like VanEck have launched new exchange-traded funds (ETFs) tracking cryptocurrencies such as Avalanche (AVAX), indicating growing institutional interest and the mainstreaming of digital assets.

Security Concerns and Quantum Computing Threats

The advent of quantum computing poses potential threats to blockchain security. In response, companies like BTQ Technologies have initiated testnets designed to defend against future quantum attacks. These proactive measures are crucial, considering that approximately 6.26 million BTC—valued at over $2 trillion—are currently exposed due to visible public keys on the ledger. The development of post-quantum cryptography is essential to safeguard the integrity of blockchain networks in the face of advancing technology.

Market Sentiment and Future Outlook

Investor sentiment remains cautiously optimistic. While Bitcoin and Ethereum have shown resilience, the market is sensitive to external economic factors, including potential changes in U.S. monetary policy and global economic indicators. The Fear and Greed Index, a measure of market sentiment, currently indicates a state of “Greed,” reflecting high investor confidence. However, the market’s future trajectory will largely depend on regulatory developments, technological advancements, and macroeconomic trends.